Real Estate Impact Investing

We are reimagining what public and affordable housing can be.

Through strategic Public-Private Partnerships with HUD and local housing authorities, our mission-driven firm is revitalizing distressed properties and unlocking opportunity for families nationwide. Our 3-part resident advancement system helps individuals exit poverty in just 2–3 years, with measurable progress in education, employment, and health.

At the heart of our work is a pioneering Impact Fund focused on redeveloping over 2,100 housing units across multiple pilot sites—bringing safe, dignified housing to over 2,000 families in year one alone.

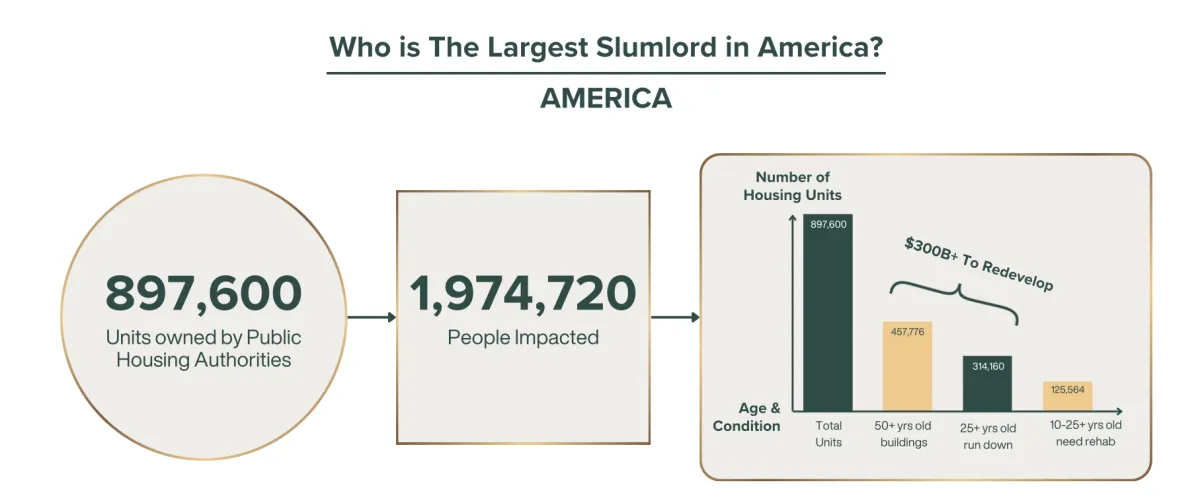

Public housing is broken. We're building what comes next.

Why Impact Investing?

Impact-focused private investments have historically been under capitalized, even when offering compelling risk-adjusted returns. Our platform is strategically positioned to address this market inefficiency, unlock untapped value and be a leader in solving real problems facing real people.

Subscribe to stay connected.

Contact us

Connect With Us

The strategy's objectives are not guaranteed to be achieved. This material is for informational purposes only and does not constitute an offer to sell or a solicitation to buy any interest in the fund. Any such offer will be made exclusively to qualified investors through a private placement memorandum. There is no guarantee that the Fund will meet its stated objectives. Projected yields and returns ("Projections") are based on numerous assumptions and factors, many of which involve subjective judgment and analysis. These projections are intended to illustrate the risk level the Firm is likely to pursue in connection with the Product, with higher Projections reflecting greater associated risk. They are not promises or guarantees. The Projections rely on assumptions such as, but not limited to, current and future asset yields, projected cash flows, prevailing and future market and economic conditions, interest rates, leverage costs (if applicable), historical and projected credit performance, and other variables beyond the Firm's control. Projections are inherently uncertain and subject to change without notice. Unforeseen events or factors not accounted for may impact outcomes. Projections should not be relied upon when making investment decisions. While the Firm believs there is a reasonable basis for the Projections presented, no assurances are given regarding their accuracy, and there is no guarantee they will be achieved. Additional details regarding the assumptions underlying these Projections are available upon request.

Copyright (C) 2024. Impact Growth Capital. All Rights Reserved